GDP and bottlenecks

Shortages are acting as a brake on the economic recovery, which may result in a different market cycle for property than has been previously experienced.

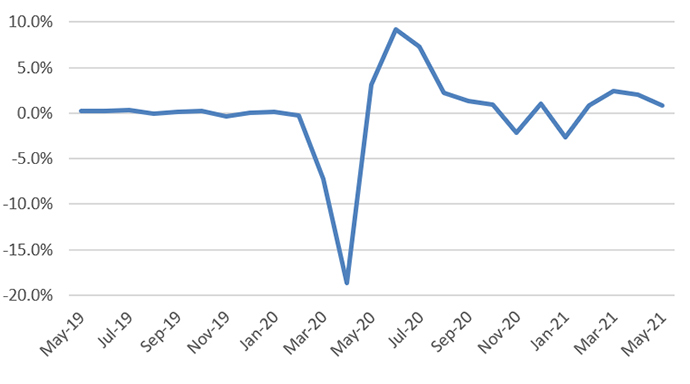

The latest UK GDP figures reported 0.8% growth month-on-month in May 2021, which fell short of the consensus forecast of 1.5% growth. The figure was far from weak – the pre-pandemic 10-year average was 0.1%. After the sharp growth increases recorded in March and April – 2.4% and 2.0% respectively – it was widely expected that growth would recede back towards normal levels with each succeeding month. Nevertheless, the speed of the deceleration has surprised economists.

Source: ONS

Global chip shortage

The ONS has attributed the slower growth to supply bottlenecks in the global economy, such as the shortage of semiconductors which has actually forced many leading carmakers to shutter production. Indeed, the GDP data shows the UK saw a 16.5% fall in car making in May. The shortage is also probably holding back consumer sales, with a range of electronic goods becoming scarce. Stocks of the new Playstation and Xbox consoles are quickly selling out as soon as new supplies reach stores.

Surprisingly at this early stage in the recovery, we are also starting to hear reports of labour shortages, usually for skilled roles. While government figures show unemployment still above pre-pandemic levels in April at 4.7%, survey and anecdotal evidence suggests June and July has seen a rebound in the labour market. Brexit may also have worsened the situation due to EU nationals leaving the country.

Rising costs

The likely next step is competition for whatever is in short supply in the coming months, then supply rising to meet demand over the medium-term. Within the semiconductor industry the consensus is that it will be next year when supply catches up with demand, and the timeline will probably be similar for retraining workers to match the skills shortages. In the meantime, prices and wages will increase, and stoke inflation concerns.

This could create a situation, whereby the GDP figures are higher in 2021, but businesses earn higher profits in 2022, as that is when they can meet demand without either lockdown rules or supply constraints acting as a brake. This could all make 2022 the year in which businesses prosper.

Construction hit

For the property sectors, all this will have very mixed consequences. The construction sector is facing a double hit of rising material costs and labour shortages, which will reduce the pipeline of new supply. This will be felt in rents and pricing for the property sectors that are already seeing the highest demand, namely logistics and residential.

For the more embattled property sub-sectors, higher wages and costs will heap further problems on those tenants who are already struggling to pay the rent. Figures from Remit Consulting show that 35 days after the March 2021 quarter day, 44% of leisure and 63% of retail tenants had still not paid their rent. This adds to the risk of tenant defaults, and ultimately the bank taking control of the asset. We see early 2022 as a time when more corporate recovery sales will be coming to the market.

The overall message for property is that this cycle is looking different to those that came before. We are used to ‘bath shaped’ recoveries, where activity comes back gradually at first then quickly further down the line. This cycle has seen rapid upfront movement, but looks set to settle into a steadier pace from next year onwards. Property investors need to be ready to adapt their strategies according to the changes ahead, particularly on development timing, where there is potential to lock in higher costs now only to see them ease next year.