With industrial real estate values not wavering, is it time for more owner-users to take advantage and monetize their real estate?

We are increasingly being engaged by owner-occupier clients to use our corporate finance sale leaseback strategies to monetize their real estate holdings to support business expansion or other financial obligations, while capitalizing on sustained industrial asset valuations. While these types of investments are very common amongst domestic industrial asset buyers, they are now also on the radar of our global investors as well. In this newsletter we take a look at recent sale leaseback activity and drill down into who is buying, and selling, how they are being executed – and what’s ahead for this unique investment vehicle.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Sale Leasebacks: The hot ticket for occupiers and investors

Sale leasebacks have been a popular investment approach for many years, particularly among industrial tenants with highly specialized or mission-critical facilities. With industrial real estate values at historic highs, many occupiers are turning to sale leasebacks to monetize their real estate holdings while remaining in the facility and maintaining stability within their critical locations and operations.

Many businesses that experienced a reduction in revenue during the pandemic are ideal candidates for sale leasebacks, as the funds can help reposition a struggling business line or provide overall financial support for modernizing the facility, funding capital expenditures or buying new equipment. Investors benefit from the steady rental income stream and the security that comes with ownership in the property having had the opportunity to fully vet and underwrite transactions.

Additionally, these type of transactions are increasingly on the radar of global investors looking to build scale across multiple assets and market segments. The Carlyle Group, for example, recently made a high-profile move into the sale leaseback market with its $3 billion purchase of developer iStar’s net lease business., according to Private Equity News.

While other net lease investors have been building their portfolios asset-by-asset, Carlyle’s sweep of 18 million square feet of industrial, office and entertainment properties across the country is notable in its size and scope. It follows another $10 billion investment they completed in the net lease market last year. The net lease market in the U.S. and Europe is valued around $12 trillion and is expected to continue to attract new investors.

A review of Real Capital Analytics data for the past year shows that industrial sale leaseback transactions in the U.S. totaled $3.4 billion across 39.3 million square feet of space. As investors look to expand their scale in the industrial sector, some are buying portfolios of sale leaseback properties.

Among the notable portfolio sale leaseback transactions in the past year was the $557.1 million acquisition of a 9.3 million-square-foot, six-building portfolio of J.C. Penney distribution centers in six markets. The properties were in Atlanta, Charlotte, Columbus, Dallas, Kansas City (KS), and Reno. The buildings ranged in size from 598,168 square feet to 2.16 million square feet.

The retailer has been struggling for years and was one of the largest retailers to file for Chapter 11 bankruptcy protection during the pandemic. The business emerged from bankruptcy after being acquired by retail mall owners Simon Property Group and Brookfield Asset Management. The company has closed many locations, but its industrial distribution centers are seen as valuable in supporting online sales growth

Also, KKR purchased Bluetriton Brands’ five building, fully leased portfolio in Los Angeles and Orange County, California for $45.7 million.

Many of the buildings that traded as sale leasebacks over the past year were vintage buildings, with an average age of 40 years. Those facilities were likely built specifically for that tenant, making them ideal candidates for sale leasebacks. The JCPenney portfolio, for example, includes buildings constructed between 1947 (with that building modernized in 1979) and 1998.

Overall, just seven of the buildings that traded over the past year were five years old or newer. One example is a 780,000-square-foot facility built in 2021 for Goodblend, a cannabis industry investor. It was sold in a $41.5 million sale leaseback to Innovative Industrial Properties.

Sale leasebacks touch many industries

Sale leaseback transactions reported by Real Capital Analytics covered a range of business categories, from energy and heavy machinery companies to those that support energy related businesses. Chicago-based Ryerson completed a 1.45 million-square-foot sale leaseback totaling $100.5 million and covering facilities in Memphis, Tulsa, Pittsburgh, Houston and other markets. The buildings were constructed between 1959 and 1995.

As these examples show, sale leaseback activity is occurring throughout every region of the country, from large metros such as Los Angeles and Chicago to small- to mid-sized cities in the Midwest, Texas, Florida, and across the Mid-Atlantic and the Northeast. The average size for the transactions covered was 254,000 square feet.

Sale leaseback activity should look to expand in 2022, as businesses continue to monetize their real estate holdings and take advantage of today’s robust investment market.

Sources: AVANT by Avison Young, Private Equity News, Real Capital Analytics, The Real Deal

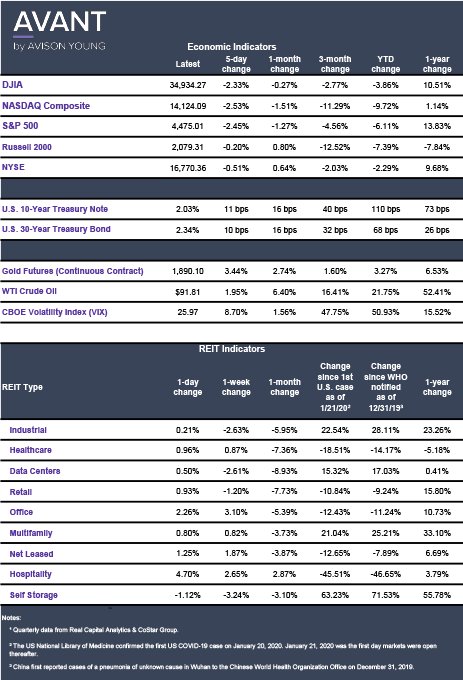

Click the image for Economic Indicators.