Investor appetite unabated as significant deals occur across all market segments

Strong industrial investment volumes heading into year’s end

As the end of the year approaches, there is plenty of good news to share about the performance of the industrial sector in 2021. Transaction volume, asset pricing, cap rates, and the state of M&A activity are all strong and expected to continue at a favorable pace into 2022. In this issue, we dig a little deeper into industrial investment activity and highlight several significant transactions and what they mean for investor activity heading into the New Year.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

October update: Industrial sales increase by double digits

A recent review of industrial sales volume by Real Capital Analytics (RCA) shows a market sector that has rebounded with a vengeance after a slight pause during the early days of the pandemic. Much of the activity can be tied to investors’ voracious appetite for e-commerce and logistics facilities that can connect retailers and other businesses to growing population centers. This is true in core industrial markets as well as growing secondary markets with strong connectivity to national distribution networks.

According to RCA, year-over-year U.S. industrial transaction volume grew by triple digits from April to September of 2021, while slightly moderating to double digits in October 2021. This shift reflects the market pivoting past the year-over-year comparisons that included declining sales volumes in the early days of the pandemic. year-over-year sales levels in April to September of 2020 declined by 43% from 2019, for example. The industrial sector has now moved beyond that pause in activity and all eyes are on continued growth in 2022.

For example, sales volume in October 2021, reached $9.9 billion, $1.5 billion higher than the average volume in October for each year from 2015 to 2019. Given that sales volume for October was 18% above pre-pandemic levels, investor appetite for industrial appears to be on the upswing.

E-commerce, logistics drive portfolio sales

Much of the recent sales activity was in the portfolio and entity-level sales categories. The blockbuster transaction of the year was EQT Exeter’s $6.8 billion portfolio sale of 328 U.S. industrial assets to GIC, a sovereign wealth fund in Singapore. The portfolio of corporate occupied properties was 95 percent leased at sale to companies involved in e-commerce, regional distribution, fulfillment, and last mile distribution.

The assets are located throughout major logistics hubs such as New York, Los Angeles, Dallas, Chicago, and Atlanta. Many properties also tie into air cargo distribution centers in Memphis, Indianapolis, Columbus and Louisville, underscoring the importance of regional industrial junction points that are strategically positioned to help move goods throughout the country.

More recently, Blackstone continued its industrial expansion with the acquisition of a $2.8 billion logistics portfolio sold by Cabot Properties, Inc. The Value Fund V portfolio included 124 assets totaling 17.4 million square feet. Blackstone and Cabot have closed nearly $5 billion in real estate deals over the past four years, according to Bisnow.

Another notable Blackstone deal was the $3.1 billion purchase of WPT Industrial Trust by Blackstone Real Estate Income Trust (BREIT), which led the entity-level deal volume for October of 2021. That deal increased Blackstone’s present in the logistics sector with a portfolio that includes 109 properties across 19 states. This transaction reinforces the keen investor interest in properties that are tied to the booming e-commerce sector -- in the U.S. and globally.

Aggressive industrial pricing levels

Cap rates are also reflecting the robust demand for industrial assets, falling 20 bps from October of 2020 to hit 5.7% in October of 2021 across all asset classes. Warehouse and distribution assets continue to see the most aggressive cap rates, hovering below the 5.7% range seen for overall industrial assets, while flex space showed more movement, dipping to 5.8% at the beginning of 2021 and edging up to 6% in October.

An RCA review of year-to-date U.S. industrial transactions through October 2021 showed an overall volume of $107.6 billion across nearly 8,000 properties. The average price per square foot was $116, but that a closer look by market showed the figure jumped to $480 in the NYC Boroughs, $358 in San Jose, and $304 in Orange County.

The West region had the highest YTD sales volume ($31.4 billion), led by activity in Los Angeles ($6.1 billion) and the Inland Empire ($4.9 billion). Other markets of note include: Dallas ($5.1 billion), Chicago ($4.9 billion), and Atlanta ($5.3 billion). Los Angeles had the lowest average cap rate at 4.1%, followed by the NYC Boroughs at 4.3%.

M&A and fundraising still active

Mergers and acquisitions are also occurring at a steady pace, as industrial entities look to scale up quickly and enlarger their portfolios with well-located assets aligned with strong occupiers. One recent example is the acquisition of Monmouth Real Estate Investment Corporation (NYSE: MNR) by Industrial Logistics Properties Trust (ILPT) for $4 billion. The transaction brought 126 industrial assets into ILPT’s portfolio, adding geographically diverse, modern assets. These properties are leased primarily to investment grade tenants, which adds the stability and long-term growth potential investors desire.

Fundraising has also been strong in 2021. Mapletree U.S. Logistics Private Trust recently closed a $1.4 billion fund which was fully invested at closing and has $3.3 billion in assets. This follows a third quarter 2021 acquisition of two logistics portfolios in the U.S. comprising 141 high-quality assets for approximately $3 billion. Those assets will become part of a fund of 155 logistics properties.

The Avison Young Industrial Capital Markets team expects solid investment activity to continue into 2022, with investors focused on portfolios that can support the growing e-commerce sector through distribution, fulfillment and last-mile warehousing. Large investment groups will continue to search for portfolios that allow them to expand their presence quickly and tap into this coveted sector.

Sources: Bisnow, Businesswire, GlobeSt., IREI.com, Real Capital Analytics, The Real Deal

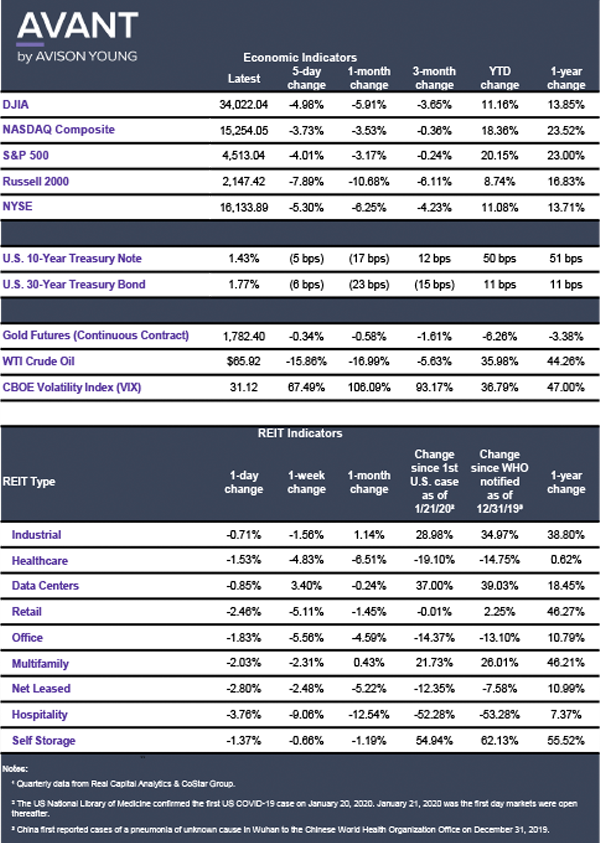

Click the image for Economic Indicators

Erik Foster joined host Mariam Sobh and Oxford Properties Group’s Jeff Miller to discuss the latest in warehouses. Listen to the full epsiode here.