Maybe a different AND better 2023?

While uncertainty has gripped the commercial real estate industry for the last several months, there are plenty of reasons to be optimistic about the industrial asset class as we turn the calendar to 2023. Market fundamentals are strong for industrial and the same demand drivers that fueled record activity over the past several years remain in force. As inflation begins to moderate (fingers crossed), we are hopeful for a return to greater stability in the economy and an expansion of deal flow in 2023.

Here's to a safe and happy holiday season!

Principal

Head of Industrial Capital Markets

[email protected]

+1 312 273 9486

CRE Industry Looks Long-Term for Stability

Despite uncertainty, fear and dread (and perhaps because of unending holiday dinners) there is still plenty of long-term optimism in the industrial real estate sector as compared to the other major asset classes. The sentiment for commercial real estate capital markets is complicated heading into 2023, as rising interest rates, a pull-back in lending, and the threat of a recession cast a shadow over much of the industry. Yet, in the industrial sector, these headwinds are pushing back against strong fundamentals and demand drivers that have propelled industrial to the top of the list for many investors.

Here's a look at where we are as 2023 approaches.

Interest Rates Still on the Radar (and are were ready to look behind us)

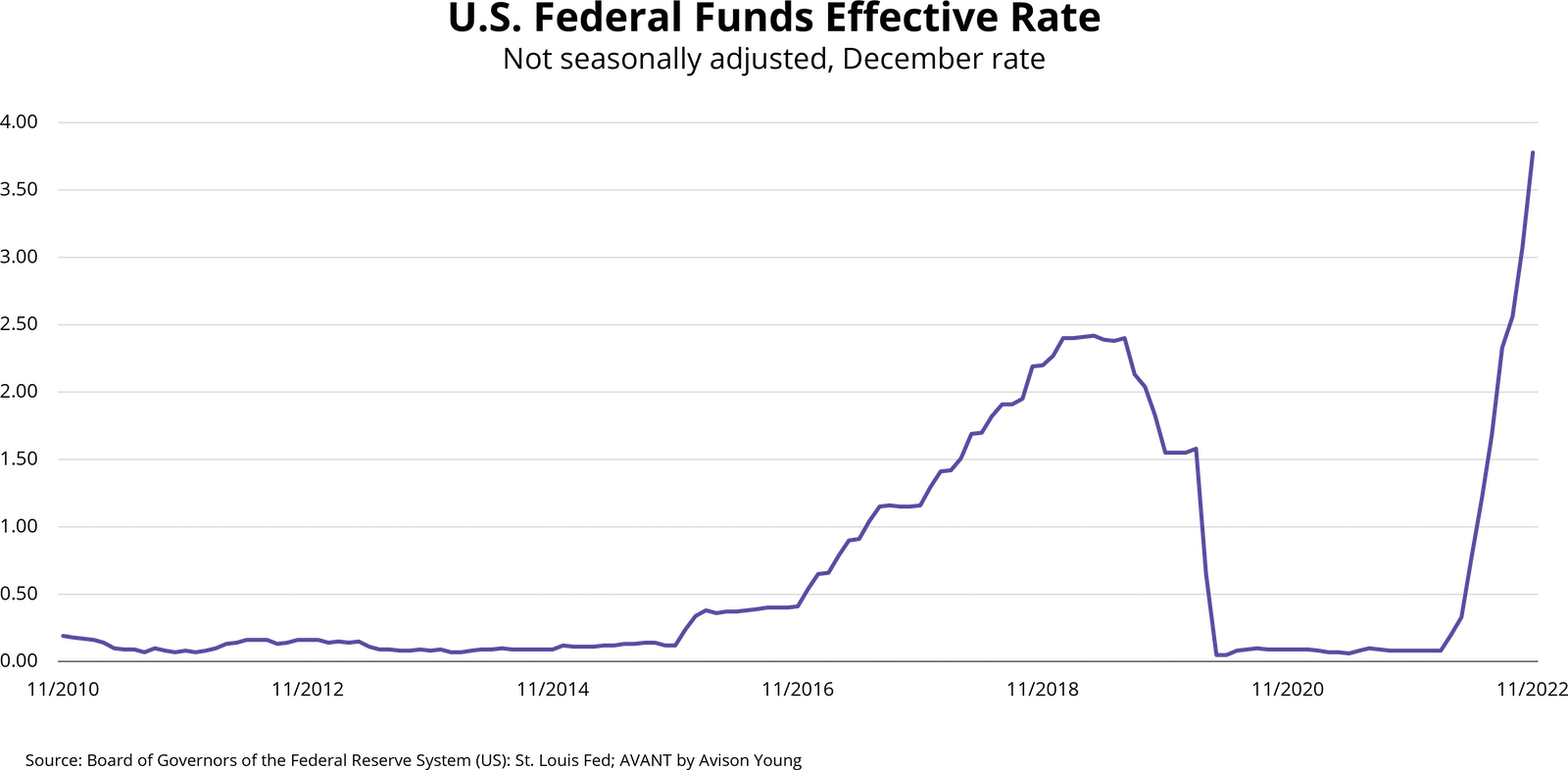

Rising interest rates have been a top story over the past six months and will continue to shape market activity into 2023. The Fed's 50 basis point increase on Wednesday, the seventh increase this year, reflects the mild slowing of inflation to 7.1% in November but is a reminder that the Fed is not finished yet.

It does offer some hope that the more aggressive rate hikes -- four previous 75 basis point increases starting in June 2022 -- are in the rear-view mirror. While many measures of inflation, such as commodity pricing, are improving, there is likely more FOMC manipulation to be done to bring down inflation to the Fed's target rate of 2%.

The long-range investment outlook for commercial real estate remains positive, but economic uncertainty and variances among the different sectors are important factors for investors to consider. According to J.P. Morgan Asset Management's 2023 Outlook, private real estate assets seem well positioned to provide diversification and stable cash flows. While pricing on industrial assets remains high, the office and retail sectors are showing signs of near-record vacancy rates. On the lending side, there is a higher probability of a distressed cycle in 2023 for office and retail assets, given rising interest rates, potential for a recession and the weak underlying office and retail asset fundamentals which continue to get worse.

And, the lending pause that hit the commercial real estate debt markets in the second half of the year is not expected to lift soon, according to participants at the recent New York University-Schack Institute of Real Estate capital markets conference. Experts at that conference predicted that many large national bank lenders will stay on the sidelines into 2023 and perhaps longer, yet there is hopes of other lending sources, such as life companies and regional banks, will have fresh allocations of capital for lending in 2023.

Industrial Sales Update

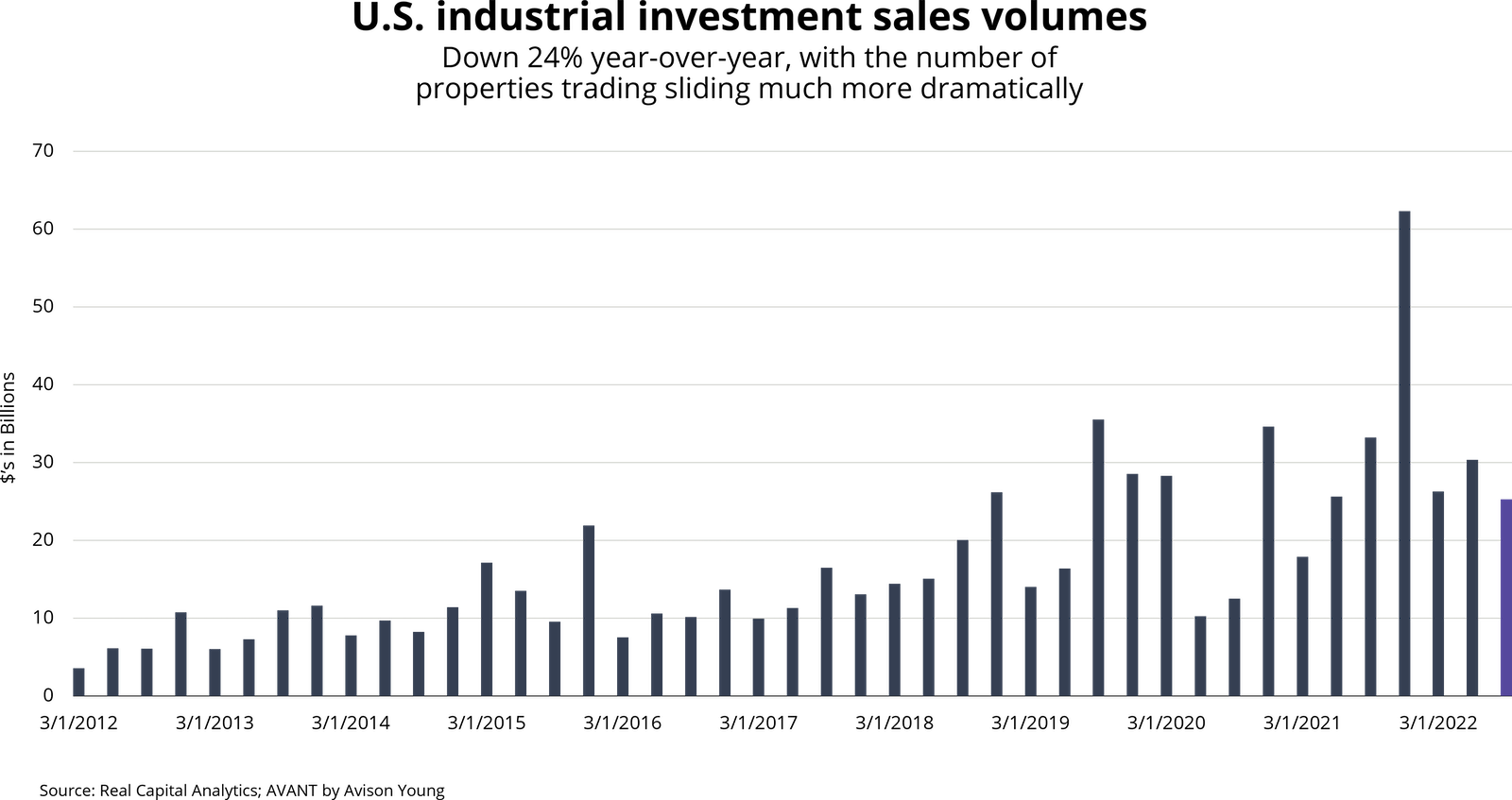

Rising capital costs, shifts in lending requirements and other factors have led to a slowing of investment sales across asset classes. The uncertainty around future interest rate increases is also weighing on the minds of investors and developers as they try to plan long-term strategies.

In the industrial sector, Q3 2022 industrial sales totaled $25.2 billion, a 24 percent drop year-over-year, according to Real Capital Analytics (RCA) research. The number of properties sold was 1,378, a 41.5 percent decline. The average price per square foot rose by 10.3% to $128. The average cap rate was 5.3 percent in Q3 2022, up slightly from 5.2% in Q2 and the same as Q1.

When viewed over a four-quarter timeframe, ending with Q3 2022, industrial sales reached $144.2 billion, a 29.5 percent increase year-over-year.

The industrial sector continues to see strong leasing demand for space, given the ongoing modernization of corporate supply chains, the growth in e-commerce and manufacturing and other factors. Industrial occupancy remains at record or near record levels in many markets, and rent growth has been consistently strong given space shortages.

According to Prologis, rent growth exceeds 10% and low vacancy is expected to produce another year of double-digit growth. The rapid increase in capital costs is expected to slow U.S. warehouse development starts to a seven-year low, however. Construction starts are already 30 percent below their peak in Europe and that trend will continue in the U.S., creating a further space shortage in 2024. Prologis expect the pipeline to drop from more than 500 msf in Q3 2022 to 275 msf by year-end 2023.

Given the wide ranging impact of rising interest rates, the commercial real estate industry is facing many challenges heading into 2023. The industrial sector should continue to benefit from positive market fundamentals and growth drivers, but much depends on the trajectory of interest rates and when the market can achieve a broader sense of stability.

Sources: Bisnow, JP Morgan, Real Capital Analytics

Download Economic and REIT Indicators