The department store is dead… Long live the department store?

.png/c740f066-37ca-df29-f9da-f66e028bee76?t=1689775298504)

Is the department store truly dead or has it evolved beyond recognition?

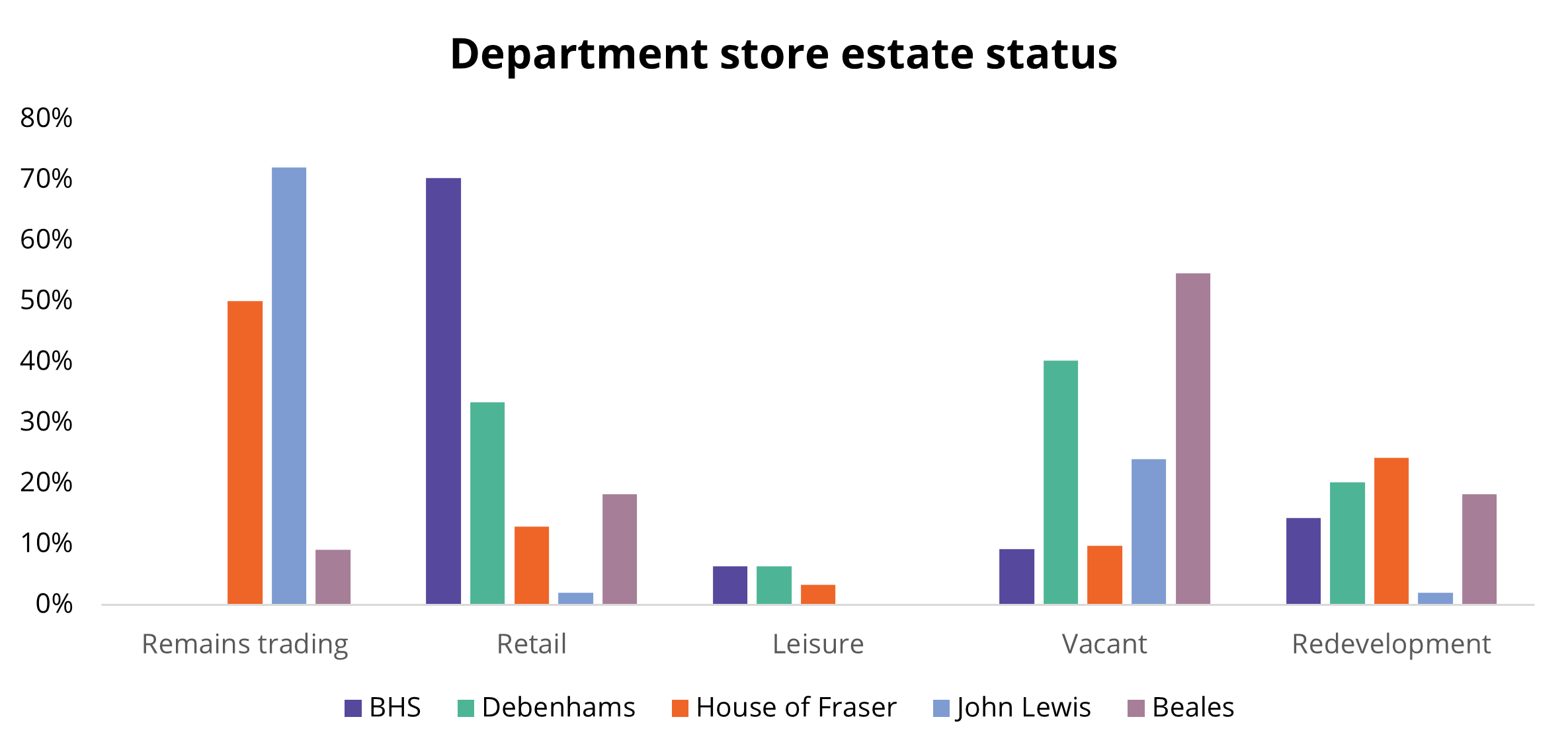

The decline of the department store sector has been underway for the last 10 years. Data from Storepoint shows that 85% of department stores occupied by the former ‘traditional’ operators (Beales, BHS, Debenhams, House of Fraser and John Lewis) have closed down. The first casualty was BHS and since then, the problems have deepened further. Even high street stalwart John Lewis has been forced to close stores and is now said to be proposing a change to the structure of its long-established partnership model in an attempt to return to profit. But is the concept of the department truly dead or has it just evolved into something unrecognisable to the traditional department store model that we all know?

Source: Storepoint

No longer fit for purpose?

Before the internet, shoppers flocked to department stores as they were perceived to sell quality products under one roof, where they could spend hours browsing a wide selection of products ranging from clothing to furniture. Our tendency to shop online has been cited as one of the reasons that department stores have been failing, however this is not the case. The decline can be attributed to a multitude of factors including poor management (certainly in the case of BHS & Debenhams), rapid over-expansion of physical store estates, a lack of digital investment and a failure to keep up with ever-changing consumer behaviour. The design of many of these stores remained unchanged over the years, with product ranges lacking inspiration meaning people no longer found them the exciting destinations to shop in that they once were. As consumers increasingly found what they needed elsewhere, sales declined until some of them were no longer viable businesses.

Obviously, this isn’t the case for all department stores though. There are some fantastic examples of department stores which have are successful. Selfridges is one of the standout examples, which continues to innovate, and introduce new concepts and ranges to attract customers. Its flagship Oxford Street store is one of the go-to destinations in the West End of London. Harrods is another great example of a successful department store where sales are reportedly “trading ahead of 2019” levels.

What has happened to the traditional department store operators?

Half of the original House of Fraser estate and almost three quarters of John Lewis stores that existed 10 years ago still remaining trading today. For those that are no longer occupied by the traditional department store occupiers, 55% are still being used for retail purposes. But how have the estates of the closed stores been carved up and which occupiers have benefitted from the downfall of department stores?

British Home Stores (BHS)

In the seven years since BHS ceased trading, over 70% of them are still being used for retail use. The majority of the estate was located in town centres, with a small number on retail parks and in shopping centres. Fashion stores have been the main beneficiaries and now occupy over a third of the properties. Primark were the biggest benefactor of the store closures, acquiring more stores than any other single occupier in cities including Leeds, and Newcastle upon Tyne. Value chains, including B&M, Home Bargains, Poundland and Wilko’s also expanded their store estates by moving into ex BHS stores.

The former store on Oxford Street in Central London has been converted into a mixed use retail and leisure destination. The upper floors are now home to popular leisure facilities comprising of an indoor crazy-golf facility (Swingers) and a food market hall which hosts a variety of street food restaurants as well as bars, highlighting the ever increasing conversion of former retail units into leisure destinations.

John Lewis

The once stalwart of the sector, John Lewis, has struggled recently but the majority of its estate remains trading. Prior to the pandemic it had only fifty stores trading across the UK but had a strong omnichannel presence following significant investment into its digital capabilities so its exposure to the woes seen in physical retail was lower than the other department store operators. But it was not immune from the impact of the pandemic and announced that sixteen stores would not reopen following the end of the lockdown periods.

It has recently launched a new, smaller store format in its former ‘At Home’ branch in Horsham. This mini department store is just 47,000 sq. ft in size (compared to the average 150,000 sq. ft sized department store) and features the standard departments you would see in a typical department store (technology, health & beauty and range of fashion brands) but it has been designed to reflect the needs of the local community and offers additional services such as nursery, personal styling and sleep advice, as well as a dedicated area to keep children entertained. Could this new format be the blueprint for the future?

Private-rented residential developments will also play an important part of its future strategy, with three sites having been announced as the location for up to 10,000 new homes in the next ten years (including its vacant warehouse in Reading) - could excess store space result in stores being downsized in the future, and converted into residential to address this challenge?

House of Fraser

House of Fraser entered into a compulsory voluntary arrangement (CVA) in May 2018 and permanently closed thirty-one stores in the weeks leading up to August 2018, when it was forced into administration. Sports Direct subsequently acquired the business for £90 million and hoped to turn the chain into the ‘Harrods of the High Street’ however this did not materialise and the following year owner, Mike Ashley, expressed regret at acquiring the business due to structural problems integrating the business. Over thirty of the stores remain trading today but there are some that are due to permanently close in 2023.

Of the closed stores, almost half of them have been earmarked for redevelopment. This includes the flagship store on London’s Oxford Street which will be converted into mixed use scheme which will include retail, offices, a gym and a rooftop bar and the former store at Westfield London which has been acquired by the Ministry of Sound and will be converted into a gym, restaurant and offices in 2024 where it plans to hold "fitness raves".

Debenhams

Debenhams ceased trading at the start of the pandemic, although rumours of its demise had been circulating in the years prior to this due to well documented financial. There is a fairly even split in terms of units that remain vacant compared to those occupied by new (retail and leisure) tenants. Marks & Spencer have acquired former branches including one of Debenham’s newly built stores on a retail park in Stevenage and a former store in the White Rose centre in Leeds. Both stores are flagship and showcase its new style format, which includes the branded beauty counters and new clothing ranges from partners such as Jaeger and. Other benefactors include the Frasers Group, furniture retailer Dunelm, Primark, The Range and Next.

The increasing popularity of competitive socialising has also helped fill up some of the vacant Debenhams space. Gravity Leisure have also acquired two former units and converted into large indoor facilities which include indoor go-kart race tracks and many other competitive socialising activities whilst the top level of the former Bullring unit in Birmingham will be converted to Toca football.

The brand was acquired out of administration by the Boohoo group in 2021 for £55 million deal in January 2021 but is now an online-only brand.

Beales

Beales, one the smallest of the department store chains with twenty-three branches, closed down all stores in March 2020. After entering administration, the brand was acquired by New Start 2020 Ltd and it now trades from two stores (in the Dolphin Centre, Poole and in Southport). In an interesting move away from retail, the upper level of the Beales store in Poole, which is owned by Legal & General Investment Management, has been converted into a 20,000 sq. ft NHS outpatient assessment clinic. Eleven of the former stores remain vacant, whilst four have been identified for redevelopment.

The new department store?

Although there has been a huge decrease in the number of these assets, we are seeing other operators fill in the gap created by the loss of department stores through strategic brand and store acquisitions over the last few years.

Next

Next, has seen phenomenal success over the years both online and in physical stores. Its online platform now sells a huge range of branded products including Nike, Boss, Ted Baker, Ralph Lauren amongst many others but it has also been actively acquiring majority shares in distressed brands over the last few years including Reiss, Joules, Lipsy, Victoria’s Secret and Cath Kidston. It has also invested heavily in its digital strategy and in 2020 launched the ‘Total Platform Service’, which allows other brands to use its IT systems and warehousing infrastructure for their own online operations and results in Next earning a fixed commission.

2022 saw the brand launch its first department-style store - a 94,000 sq. ft, three storey store at the Atria in Watford featuring a beauty hall, a Mama’s & Papa’s concession, an adjoining Victoria’s Secret as well as its standard home and fashion offer. Its store on Oxford Street now includes concessions from Clarks, and Costa Coffee. It also announced a surprise trading statement mid-June with rare, good news in the current economic climate. Thanks to warm weather and a rise in real household income full price sales for the first seven weeks of the second quarter of 2023 were 9.3% higher than the same period in 2022, and a £93 million positive swing on the -5% sales it had forecast for the period. As a result, it upgraded its full year profit guidance by £40 million (to £835 million).

Frasers Group

Despite the issues integrating the House of Fraser business, Frasers Group (previously Sports Direct) has actively been acquiring vacant department stores across the country to roll out its Frasers format. First launched in the Mander Centre in Wolverhampton in 2021, the store is home to several Frasers Group brands including Frasers, Sports Direct, Flannels, Evans Cycles, Game and Belong. Since its launch, several former House of Fraser stores have been converted to this format. It announced that it will move into the former Debenhams 130,000 sq. ft Debenhams at the Metro Centre in Gateshead and as well as featuring the same brands as other Frasers stores, it will also contain a 34,000 sq. ft Everlast gym which is likely to result in an increase in footfall to the store.

Investment market

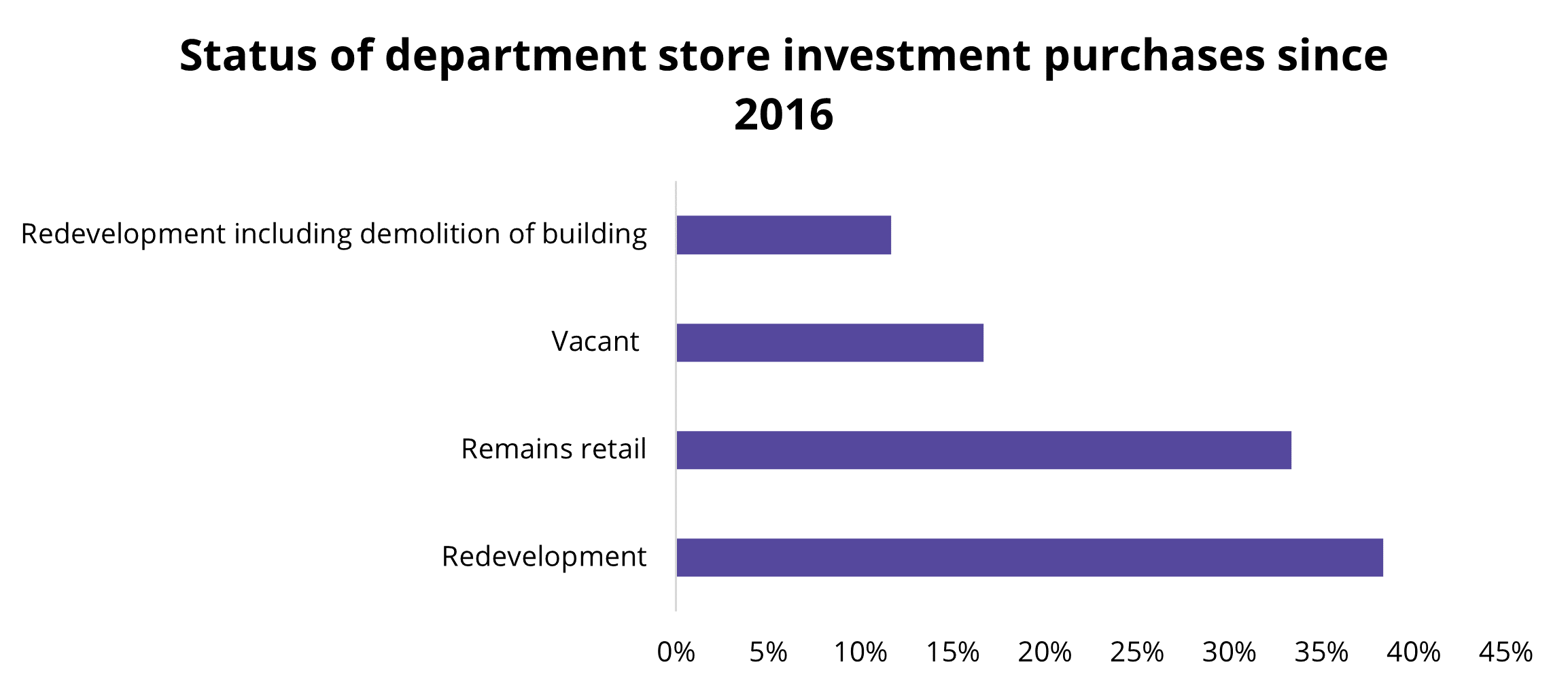

Since BHS exited the market in 2016 investment volumes for standalone department stores (occupied by the operators under analysis) stands at around £1.3 billion. Looking at the total number of deals, the highest share of those purchased (35%) have either already been redeveloped or have plans in place for future redevelopment. Residential is the most common use accounting for almost half of redevelopments, whilst 14% of them will become hotels.

Source: Propertydata

Private investors accounted for the majority of these purchases, and almost half of them (48%) will be redeveloped – the remainder are still being used for retail or lie vacant. Local authorities acquired the second highest share of department stores, with 60% of those acquisitions redeveloped. Of the redevelopments, the majority of them will be, or already have been, turned into residential use – with the existing building demolished to make way for the new schemes.

What next for department stores?

Whilst the traditional model for department stores is now outdated we do expect to see further innovation and development in the stores that still exist, much in the way that we are seeing with Frasers Group and John Lewis’ new smaller format. Occupiers are now much more aware of the need to adapt quickly to consumer behaviour and are also much more aware of their customers’ needs thanks to advances in customer data collection and analysis over the last decade, so it is unlikely we’ll see department stores disappear entirely. Could we see an increase in the number of pureplay (online-only) retailers opening physical stores in former department stores, particularly those operators that are struggling to grow online sales, as an increasing number of shoppers, and tourists, return back to shopping in physical stores?

Of the vacant stock remaining there will have to be careful consideration around the redevelopment of these sites, particularly in relation to demolishing the sites, due to the impact of embodied carbon. The introduction of the ‘E’ planning use class (Commercial, Business and Service) may also help with future redevelopment of these stores as this allows owners of vacant retail stores to change the use of their properties to a broader range of other uses such as offices, without the need for planning permission.

Some stores will no longer be viable for retail or leisure purposes so we could the space being used for alternative uses; in Great Yarmouth, the former Beales store is to be transformed into a learning hub and we may see more conversion into health facilities similar to the NHS centre in Poole.

Contact us