A nightmare before Christmas?

As we head into retailers’ busiest time of the year, will we witness a surprising increase in sales compared to last year, a last hurrah perhaps before the cost-of-living crisis really bites, or is this likely to be one of the worst-performing golden periods for some time? The outlook certainly makes grim reading for many retailers as they witness sustained declines in retail sales volumes, which, combined with soaring costs, is a huge cause for concern heading into the festive season and into 2023.

The economic backdrop is having a significant impact on consumers. For many, it will be a very challenging period as they have to contend with cutting back on both discretionary spending and essentials to pay household bills. A recent survey by Retail Economics/Metapack found that UK consumers are forecast to spend up to £4.4bn less on non-essential retail during this year’s festive season - a 22% decline compared to last year.

Competition will be intense between retailers as they battle to win eroding consumer spend. Black Friday offers started in early November, although this is probably a combination of attempting to increase sales and offload up to £2.8bn worth of excess inventory, which has built up since the pandemic. There will also likely be a shift in shopper behaviour as consumers, who traditionally trade up during the period, trade down instead to save money, a trend already being reported by supermarket chains. Retailers, such as Sainsburys and BrandAlley, have even launched their Christmas adverts early amidst reports that customers have been doing their Christmas shopping earlier this year to spread out the cost, so this is likely to impact sales during the busy December period negatively.

So, will the season deliver any goodwill?

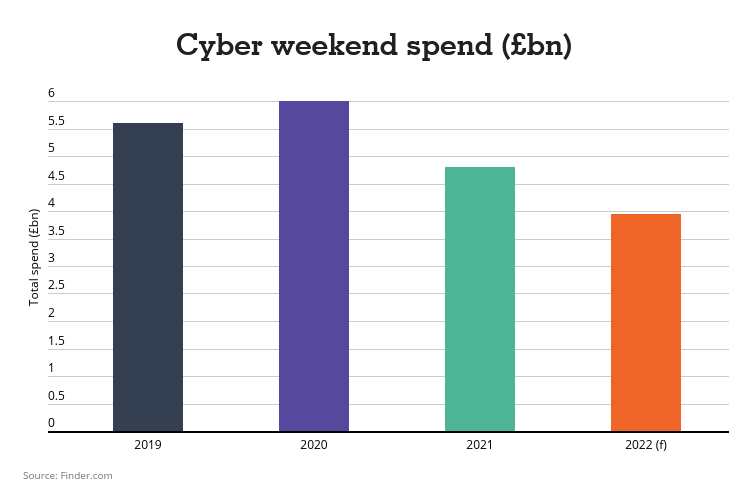

Black Friday is traditionally the busiest shopping event of the year, and this year should be no exception. Some consumers may well be holding out to splurge over the Cyber Weekend, especially in physical locations, as this will be the first restriction-free festive period since 2019, but this is unlikely to be enough to beat revenues achieved in previous years. Forecast data from finder.com indicates that spend will be significantly lower compared to the last years, with sales expected to reach £3.95bn compared to £4.8bn last year.

However, there is an added bonus for this year’s event in that, unlike any other Black Friday, it falls during the World Cup tournament. The hospitality sector will see sales boosted significantly on the day itself as England play the USA and Wales play Iran – which is forecast to bring in an additional £269 million of spend.

We should also see an increase in online shopping, which has been declining month on month for most of the year. The only exception was in July when there was an unexpected jump in retail sales volumes driven by Amazon Prime Day. Online retail sales increased by 5% month-on-month (the biggest monthly percentage rise in sales volumes in twelve months), so we could see this happen again as shoppers may decide to capitalise on some of the deals on offer.

A look at brick-and-mortar performance

In Central London, where visitor numbers still haven’t returned to pre-pandemic levels (currently 18% below 2019 levels according to Springboard), the New West End Company has forecast that spend within the West End of London will be around £1.55bn, which is 24% higher than last year for the 8-week Christmas trading period but is still 28% lower than 2019 spend levels.

Luxury retailers are likely to perform strongly over the period, as affluent customers remain largely immune to the crisis. Harrods recently announced it was on track for sales to recover this year to pre-pandemic levels driven by an increase in demand for Rolex watches and Dior handbags (although rising labour costs and energy bills will lower profits. Its outlook for 2023 is “very positive” and expects the lower value of the pound will be a benefit as it will increase sales from affluent overseas visitors.

Value retailers are also likely to weather the storm, as many benefit from consumers switching to cheaper brands. In a recent survey by Barclays, 86% of discount retailers said they were confident of growth during the golden quarter compared to only 76% of mid-range operators. However, these operators are also not immune to growing costs and will also see profits suffer.

Overall, this will prove to be a very difficult period for retailers, as profits continue to be eroded by rising costs, and the majority of consumers cut back on their purchases and retail spend. This is likely to be one of the worst performing periods in recent years and 2023 is unlikely to deliver any respite. But, as always, despite the doom and gloom, the best retailers will adapt and survive, new innovative concepts will be launched, and poor performers will fall away to make way for new, emerging players.