Why is ‘affordable’ workspace needed?

Supporting London’s squeezed businesses in precarious times

This Sightlines article, which focuses on the importance of ‘affordable’ workspace, is the second in our five-part series on affordable workspace – it builds on our previous post which considers different definitions of ‘affordability’.

London's lifeblood

When people think about London’s economy, they typically visualise large corporate businesses undertaking financial, legal, technological, digital, scientific, real estate and professional activities. While these global firms characterise places like the Square Mile, Canary Wharf and Tech City, large businesses make up less than 1% of the city’s total business base1.

London’s economy is actually underpinned by entrepreneurs, innovators, and risk takers that run micro-businesses employing only a handful of people – they account for at least 93% of businesses in Outer London boroughs and 88% in Inner London boroughs2. These enterprises undertake an extremely broad range of activities from photography and construction to graphic design and cleaning. There are also a wide range of third sector and socially oriented organisations that support the capital’s diverse communities.

While rapidly rising commercial rents have impacted all businesses, as highlighted in our first blog on affordable workspace, they have disproportionately affected smaller businesses and organisations - this is because they are typically more vulnerable to fluctuating market pressures. This has been particularly acute in some locations, including Inner London boroughs, which has pushed some of these interesting organisations out of some parts of the city, leading a loss of identity, vibrancy, and diversity (see Centre for London’s Space for Making report).

Many of these businesses are also start-ups or early-stage enterprises meaning they already face one or more barriers to entering the market. These range from needing access to specific and costly equipment to undertake their activities, to having high failure rates meaning they require low cost or flexible space to test and innovate new ideas.

Robust Response

In response to these barriers a number of specialist workspace operators have entered the commercial real estate market. They offer flexible commercial space targeted at smaller and start-up businesses across a range of specialist typologies – examples include managed workspaces targeted at digital businesses like Parkhall Business Centre in West Norwood, through to innovation-focused maker spaces for prototyping and small batch production, like Plus X in Brighton.

Some of these operators specialise in providing an accessible offer that addresses the barriers to entry facing start-up and smaller businesses, and/or providing more accessible space to businesses operating in more precarious sectors. As set out in our first blog on affordable workspace, in some cases this involves offering discounted rents, but in others it involves providing the tools, equipment, networking, flexibility or financing smaller businesses need to enter the market or grow. Example accessible operators include:

- Meanwhile Space: A Community Interest Company that activates underutilised land and buildings to transform them on a temporary basis into affordable workspaces and community hubs via a community-led approach.

- Town Square Spaces: A workspace provider that operates across the country and focuses on supporting freelancers, new company directors, and aspiring entrepreneurs to start-up, raise investment and grow their businesses through dedicated spaces in town centres.

- 3Space: A meanwhile workspace operator that works with government, developers, and corporates to make better use of commercial space to drive regeneration and benefit local communities.

- Plus X: A workspace provider that provides advanced tools and equipment to support prototyping and small batch processing (e.g., 3D Printers, spray booths, workshops, media suites).

Operators like this have opened accessible workspaces in a diverse range of ways – some have done it independently, some have taken new space in developments secured via affordable workspace policies, some have activated public sector assets, and some have entered joint venture partnerships with public sector bodies.

Inflation nation

On top of ever-rising commercial rents, smaller businesses are now facing rapidly rising inflation which is pushing some to the brink. Research from Global Web Index and Vodafone shows that 1/3 of businesses employing under ten people report that staying afloat is their main priority for 2022.

Similarly, the GLA3 report that Londoners, who typically own, run and manage the city’s smallest businesses are being hit hard by inflation:

- 19% of Londoners are financially struggling. They are going without their basic needs and/or relying on debt to make ends meet.

- 30% of Londoners are ‘just about managing’. They are able to meet their daily needs but are living precariously.

- 46% of Londoners have ‘struggled’ of ‘fallen behind’ on financial commitments. This includes mortgage payments, bills, and credit commitments.

This is problematic as these businesses sustain employment and livelihoods, and because start-ups and entrepreneurs are the cornerstone of innovation and the creation of social, human and knowledge capital.

Safe sanctuary

This rapidly changing context underlines the importance of ‘affordable’ and accessible workspace for London’s squeezed businesses at this time. To explore the value of these spaces we have run several scenarios to compare the impact of inflation on micro-businesses in ‘affordable’ workspaces versus typical market rate spaces.

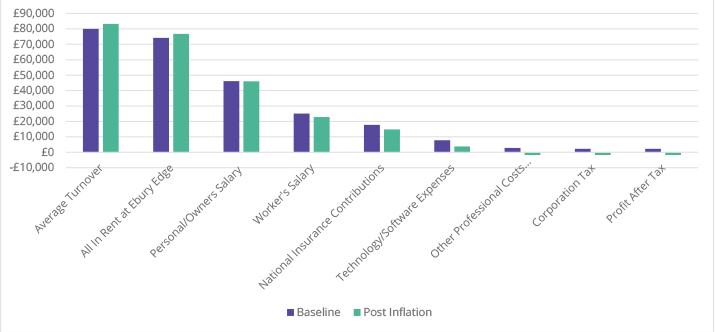

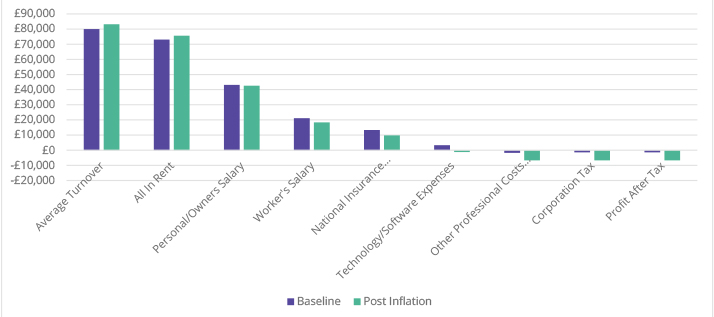

One of these is summarised in the two graphs below – these compare the impact on a hypothetical two-person start-up graphic design firm turning over £80k per annum when located in Ebury Edge (an ‘affordable’ workspace near London Victoria) versus another market rate workspace near London Victoria.

In the Ebury Edge version (Scenario 1A) the start-up can make a small profit in a pre-inflation year, even when paying workers annual salaries of £30k and £22k respectively. When inflationary pressures are applied - i.e., to rent, salaries, technology and other costs, alongside an optimistic +4% increase in annual turnover, the business makes a marginal loss.

In the market rate version (Scenario 1B) the start-up struggles to make a profit even in a pre-inflation year. When the same inflationary pressures are applied, the business makes a relatively significant loss (>£6k) even if annual turnover increases by +4%.

Scenario 1A: Graphic Design Business @ Ebury Edge, Turning Over £80k P/A4

Scenario 1B: Graphic Design Business @ Victoria Co-Working Space, Turning Over £80k P/A5

Active anchors

Given the importance of ‘affordable’ space at this time, proactive local authorities and other stakeholders, including Business Improvement Districts, Developers, Landlords, Leaseholders and Chambers of Commerce, should look to support operators as much as possible to help mitigate the economic impacts of inflation and the on-going recession.

There are a wide range of levers that stakeholders can consider from business rates relief to rental breaks. Strong partnerships are also essential at this time, as highlighted by Meanwhile Space’s Executive Director, Emily Berwyn:

“As an established affordable workspace provider, and also a social enterprise, the landscape for delivering affordable workspace over the coming year is looking incredibly challenging for us, as it is for many other workspace operators. The margins on affordable workspace are extremely tight, with rental income from tenants at below market rate, this often just covers the running costs for the space and a management fee. Often the management fee is also required to incorporates social impact delivery which requires additional resources. So, the income is less, but the resource commitment is greater than a standard workspace provider. In addition, landlords expect some form of fixed rental income, even if this is reduced in return for social impact delivery.

The cost-of-living crisis has resulted in enormous increases in the costs to run properties, as well as increased staff and services costs, while also reducing tenants’ ability to pay rent for the same reasons. This has pushed a number of our already marginal affordable workspace projects to an unviable position, and we are seeing this repeated across the landscape of other affordable workspace providers. With such risky projects, having strong supportive partners is essential or they fail. This works best when it takes the form of a collaborative approach when challenges are faced, a true partnership rather than client and commissioner vs delivery organisation to overcome viability challenges that result in project failure. Typically, this can manifest as regular project board meetings to find ways around the barriers and risks, sharing in the rewards (profits) as well as the unexpected hurdles (deficits), business rates policies that support affordable workspace, and not tying operators into restrictive leases with fixed rents.

The benefits can be plentiful when projects are successful, and can include nurturing new or at-risk industries, placemaking, support to particular demographics or those traditionally excluded from entrepreneurial opportunities, increased community cohesion and bespoke services and facilities that meet local demand and needs”.

Proactive players will also look to increase the supply of ‘affordable’ space through both policy and practice. Beyond the reasons set out above, there are other ‘innate’ reasons to support affordable provision – for example:

- They can attract new businesses to an area and support inward investment.

- They encourage entrepreneurship and innovation which are cornerstones of economic growth.

- They allow new uses and concepts to be tested in an area.

- They can diversify high streets and increase footfall when in town centres.

- They often deliver social value and can be new community anchors.

Those places that can support ‘affordable’ workspaces, and ensure existing spaces are retained for the future, will be better placed to endure and bounce back from the difficult economic times we now face.

1 ONS Business Counts, 2021

2 IBID

3 GLA, Cost of Living Polling: Tracking the Impacts of the Cost of Living Crisis on Londoners 2022

4 Baseline assumptions (annually): rent of £5,868; owner salary @ £28k and one employee salary @ £ 21k (+ National Insurance); technology costs @ £10k; professional costs @ £5k;

corporation tax @ 19% of pre tax profit; business rates @ 0%; VAT @ 0%. Inflation assumptions: +4% turnover; +10% rent; +10% increase in salary costs; +10% in technology costs; +10% professional costs; corporation tax steady, but based on revised figures; business rates and VAT @ 0%

5 As above but rent (annually): £6,912.

Contact us

Patrick Ransom is an Associate Director in our London Planning, Development and Regeneration team. He is an Affordable Workspace commentator and has undertaken research on the topic for the London Boroughs of Brent, Hammersmith & Fulham, Haringey, Lambeth, Islington, Tower Hamlets, Camden and Hackney.