Back to the Big Nine

Hope is on the horizon.

The sun is shining, restrictions are being lifted, shops, pubs and restaurants are reopening and according to Avison Young’s UK Cities Recovery Index, workers are returning to the office.

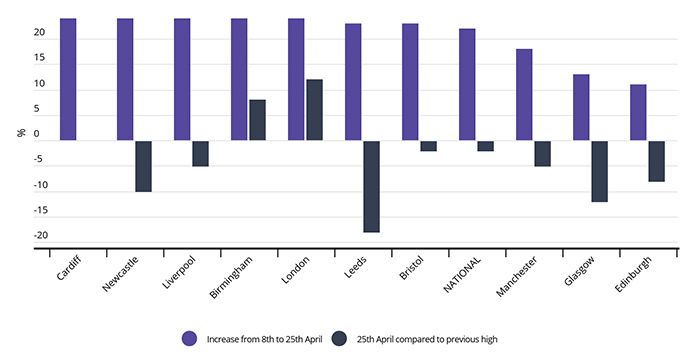

Since April 8th, the National Return to Office (RTO) sector index has increased by 22% and is now close to its highest level recorded since the start of the pandemic, at 58.5.

All ten cities covered by the Recovery Index have shown significant growth in the RTO sector index over the past two weeks, with the smallest cities Cardiff, Newcastle and Liverpool showing the most significant improvement, having rebounded by c.30% in the weeks since restrictions have lifted. The UK’s largest cities have also seen a promising increase in activity and are now higher than they have been at any point since the start of the pandemic – with London 12% and Birmingham 8% above the levels seen late last year. It seems likely that the remainder of our cities will follow suit in the coming weeks, with the restrictions in Scotland likely to see Edinburgh and Glasgow lag slightly behind other cities.

Against the backdrop of headlines heralding the death of the office and government guidance that still recommends that employees work from home where possible – notwithstanding the health implications of the virus, which continue to be as serious as they ever were – one has to take this as a positive sign for those questioning the future of the workplace. Contributory data, including public transport traffic and footfall levels, is backed up by data from Metrikus, which suggests that office occupancy levels hit 45% last week - the highest since the beginning of the pandemic.

This increase in activity has been facilitated by the loosening of restrictions, such as non-essential retail and outdoor hospitality opening as well as schools returning after the Easter holidays. Other sectors that saw a significant uptick on the Recovery Index include retail, which has increased 28% since 8th April and now stands at 90.9, and mobility, which increased by 21% to 66.5 during the same time period.

Avison Young Return to Office Index

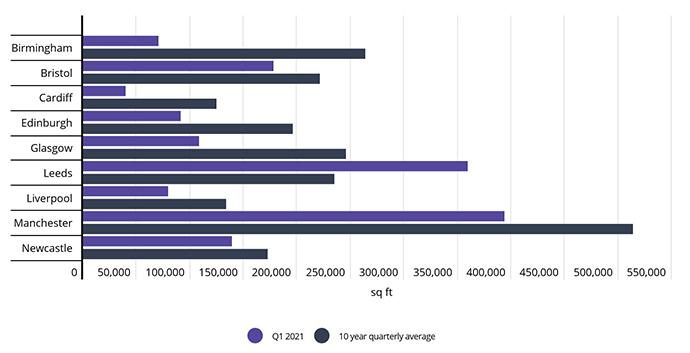

The demand from workers to get back to the office is likely to be a catalyst for businesses reactivating occupier requirements throughout the rest of the year. While occupier activity remains understandably subdued – a third down on the ten year average, our latest Big Nine office analysis reports an improvement in sentiment and an increase in enquiries during Q1, with Leeds seeing particularly strong activity, and Newcastle and Bristol – the two top performing cities of 2020 – once again seeing good levels of activity. In central London, we have just seen the busiest month of activity since the pandemic.

Big Nine Q1 take-up

We are also seeing an active public sector, with the Government committed to the levelling up agenda – with DWP committing to five deals across the cities, and the NHS and Ministry of Justice both taking significant space in Manchester. And, in what may be a sign of things to come, we have seen a return to activity from flexible workspace providers.

As we move into a post-lockdown UK, hopefully for the last time, the outlook is decidedly positive.