Forecasting the recovery

What the UK Cities Recovery Index tells us about the nation’s path to economic recovery.

Last week saw March’s GDP figure released, showing 2.1% growth, the fastest rate since August 2020. This was ahead of the majority of expectations (consensus 1.3%), which is an encouraging story for the trajectory of the UK’s recovery. Our economic forecasting model developed from our UK Cities Recovery Index was closer to the actual figure than most, at 1.7 % and its forecast for the coming months gives us hope for a faster recovery than is widely anticipated.

A bit about the UK Cities Recovery Index

Last year, Avison Young developed the UK Cities Recovery Index which blends traditional metrics with high-frequency data to produce an up-to-date picture of the performance of our cities.

It shows how six key sectors (commercial, hotel & leisure, mobility, residential, retail, and return to office) at national level, as well as within 10 UK cities, have reacted over the past year to specific changes in policy, restrictions and public behaviour.

By analysing the trends during previous post-restriction periods, we are able to forecast the recovery trajectory as the roadmap out of the 3rd lockdown unfolds. The typical trend that has emerged previously, is a strong increase immediately following a relaxation in restrictions, with recovery then slowing as the effective ceiling on activity from remaining restrictions is reached.

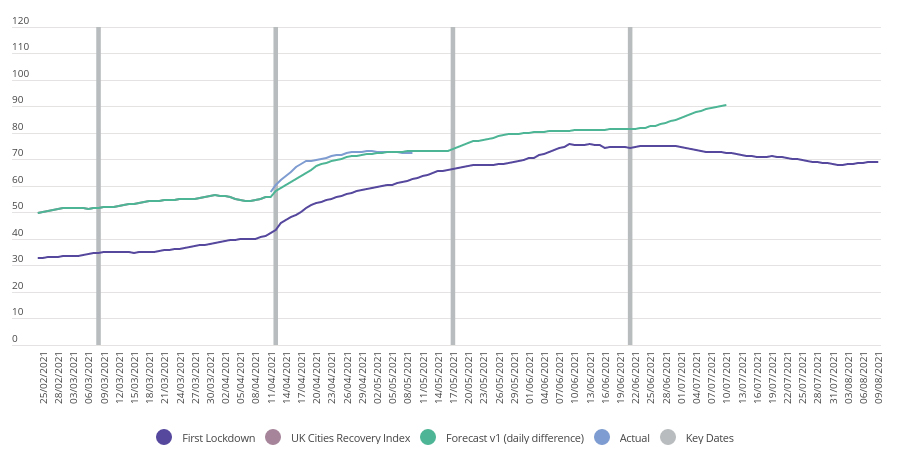

This model has proved to be an effective indicator of performance over the past year (Figure 1), with our forecast recovery of 25.9% very close to the actual movement of 26.9% between 11th April and 3rd May.

Figure 1

The economic model

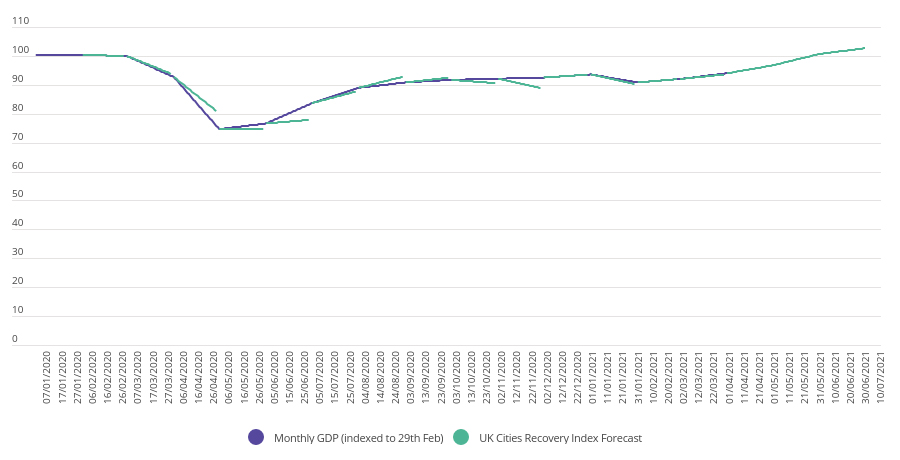

The performance of the Recovery Index has correlated closely with the UK’s GDP, allowing us to use it as a base for constructing a model to forecast economic activity as restrictions are eased. We forecast growth of 1.7% in March and for April, May and June 2.9%, 3.7% and 1.9% respectively. These are undoubtedly optimistic figures (here’s hoping) and achieving them would mean that the UK economy would grow 8.5% in Q2, double the Bank of England’s current forecast of 4.25% and well ahead of consensus forecasts at 4.8%. While recovery is influenced by a number of factors, and we may not see this extent of growth materialise, we do believe there is a good chance growth will be ahead of most forecasts.

Figure 2

Digging deeper into the current trends within the Recovery Index, we can explain why growth may outperform the consensus. Data from the Residential sector index shows that housebuilding activity is strong, and this can be seen in the official measure of construction output, which jumped by 5.8% in March. This likely reflects a surge in housebuilding activity to complete homes before the end of the Stamp Duty holiday in September.

The Hotels & Leisure, Retail and Mobility sector indices show that the public are making the most of the reduced restrictions. Activity appears to be limited by capacity rather than demand at present, indicating that further relaxations in restrictions should provide continued momentum for activity. It also suggests consumers are willing to spend savings accrued over lockdown, which is a key upside factor for the recovery as most forecasts imply that spending will occur at pre-Covid trend levels.

One area of uncertainty remains the extent to which employees will return to their offices. Our Return to Office Sector Index shows that commuting has lagged behind other areas of the economy in its recovery. This particularly impacts the city economies and may act as a handbrake if it continues to stay at historically low levels. However, if Return to Office gathers momentum, it will help unlock further spending and economic growth.

Resilience is the word

Clearly many parts of the economy still have challenges and in March, GDP was still 5.9% below its pre-pandemic level. Some components, such as business investment, performed particularly badly in Q1 (falling 11.9% q/q) which does give cause for concern, although policy support such as the ‘super-deduction’ and improving sentiment will hopefully provide a catalyst for recovery.

Risks on the horizon remain but we feel that on balance the outlook is now very much weighted towards the upside of the majority of forecasts. If the next phase of restriction easing continues to accelerate the economic recovery at anything close to the levels in our model, the economy will return to its pre-pandemic size at least a quarter earlier than most predictions.

This could well mean that property markets will be in better positions than many expected not long ago. A stronger pick-up in economic activity in Q2 will support confidence in both leasing and investment transactions later this year. Combined with signs of pent-up investment demand and UK commercial property presenting relatively good value compared to competitor cities, there is a convergence of factors to underpin a robust recovery.

If the faster recovery does play out, it is likely that inflation will come sooner than the Bank of England's Monetary Policy Committee expect, and it also maybe more sustained and have wider impacts. This will put some pressure on a policy response and could cause difficulties later in the year. Overall, we think higher levels of inflation should be fairly temporary and will fall back after the initial rise.

Avison Young's UK Cities Recovery Index monitors the diversity of market activity and the speed and trajectory of the recovery. You can view the latest analysis here.